Invest in Cash Flow with Stable Risk-Adjusted Returns

Invest in Hearthfire Income Fund -

Where Stability Meets Opportunity

Already have an account? Login Here!

Up to 10%

preferred returns

90%

reinvestment rate

Flexible

monthly or quarterly distributions

Strong, Immediate Cash Flow Yields

Earn remarkable yields without the unpredictability of the stock market. Our fund delivers risk-adjusted returns with steady cash flow.

Recession-Resistant Asset Class

Self-storage thrives in both good times and downturns, making it a safer choice to protect your investments from economic swings.

Institutional-Grade Private Credit

With banks tightening lending, private credit investments like ours are well-positioned to offer unique opportunities—and strong returns.

Diversify Your Portfolio with Confidence

Spread Risk and enhance your financial future with a low-volatility investment backed by real estate assets and expert management.

Deep Industry Expertise

At Hearthfire, we’ve built a team of industry veterans with over 90 years of combined self-storage experience. Our singular focus on self-storage uniquely positions us to successfully evaluate, deploy, and execute private credit investments backed by self-storage real estate assets.

Start Earning Monthly Distributions Now—Invest in Self-Storage Today!

Join the thousands of investors who trust self-storage for reliable income and portfolio stability.

Options that Work for You

Highest Yield

Class A

- Preferred Return: 10%

- Commitment Period: 2 Years

- Withdrawal Notice: 90 Days

$200,000 Minimum

Balanced Yield & Liquidity

Class B

- Preferred Return: 8.5%

- Commitment Period: 1 Year

- Withdrawal Notice: 60 Days

$100,000 Minimum

Yield + Liquidity

Class C

- Preferred Return: 7%

- Commitment Period: 6 months

- Withdrawal Notice: 30 Days

$50,000 Minimum

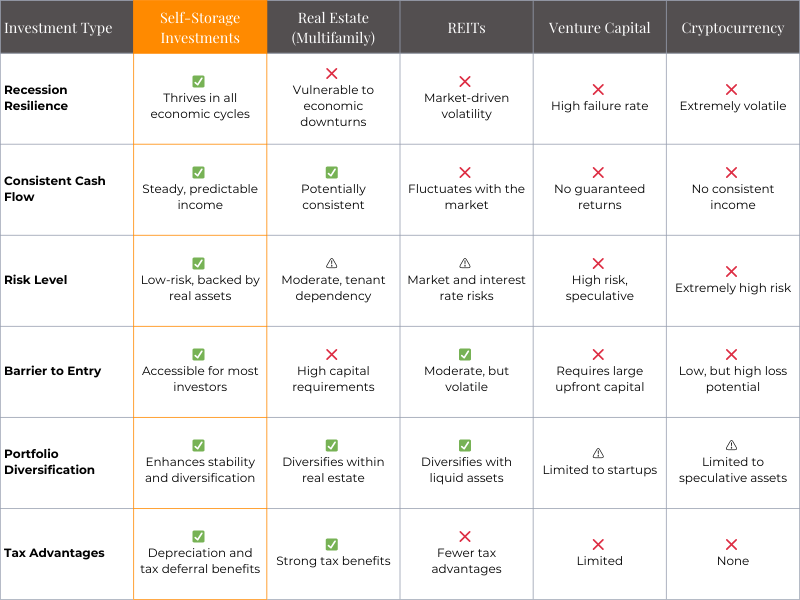

How Self-Storage Stacks Up Against Other Alternative Investments

Discover Why Self-Storage is the Smarter Choice for Growing Your Wealth

Designed for Investors Like You

For

Experienced Investors Craving Stability

Partner with us for stable returns without the stress of stock market swings or speculative investments.

For

Private Investors Seeking Yield

Enjoy the benefits of institutional-grade private credit, with a strategy proven to deliver returns across market cycles.

For

Retirement

Planning

Our fund fits perfectly into self-directed retirement accounts, providing steady income streams to secure your future.

How It Works

The Fund seeks to invest in real estate and real estate-related ventures that are primarily correlated to self-storage. All investments shall be deemed to be aligned with the risk and return profile to ensure maximum yield correlated to minimum risk.

Invest in

the Fund

A simple, transparent

process to get started.

Earn Quarterly Distributions

Enjoy regular payouts

as your wealth grows.

Monitor Your

Progress

Access reports and

updates to stay on track.

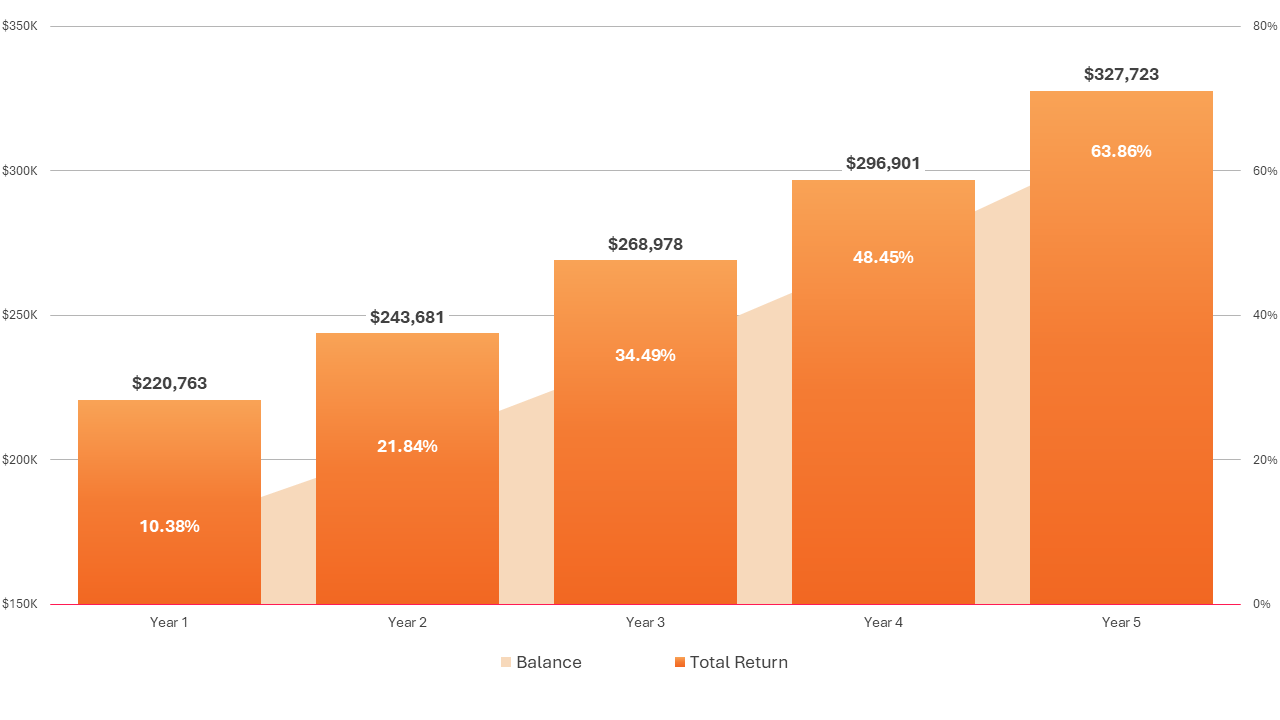

Class A Model Return

An investment of $200,000, with an APR of 10% with quarterly compounding, returns.

Ways to Invest

Join the growing number of investors leveraging strategic funding options to build wealth through self-storage.

Here are four smart ways to invest:

Reposition

Your IRA

Leverage

Home Equity

Optimize

Your Portfolio

Grow

With Cash

Tax Advantages of Investing

Investing in self-storage not only builds wealth but also offers significant tax benefits. Here's how you can maximize your investment.

- Common Equity Investment: Enjoy potential tax-deferred growth and long-term capital appreciation while benefiting from depreciation and other tax efficiencies.

- Cost Segregation Benefits: A cost segregation study will be conducted upon project completion, offering substantial tax advantages to qualifying investors by accelerating depreciation and reducing taxable income.

Secure Steady Returns—Invest Now and Watch Your Wealth Grow!

With Hearthfire Income Fund I, consistent income is just a step away. Start today!

Want to Know More?

The Hearthfire Income Fund I is an exciting opportunity for passive income with our high-yield fixed-return offering. Discover the potential of earning through lucrative investments in self-storage debt. Watch the webinar replay below and download our background documentation for more information.

Still have Questions?

Get Your Answers Today!

Request a call back or schedule a meeting with our investment team using the calendar to schedule a time to meet.

Why Hearthfire?

Who you work with matters. At Hearthfire, founders Sergio and Corinn aren’t just after the next transaction, their mission is to create wealth through meaningful connections and opportunities that enrich our communities, partners, and investors.

-

Decades of Expertise

in Self-Storage InvestmentsWe specialize in identifying and managing high-performing self-storage properties, providing a reliable foundation for your investment.

-

Personalized Service for

Every InvestorEnjoy direct access to our team of experts, with full transparency and support along the way.

-

Built on Trust and Performance

Join our investors who have chosen Hearthfire for consistent returns and long-term wealth building

There is a reason we have a 90% Reinvestment Rate

From a Single Triplex to a $180M Investment Platform

Hearthfire began not as a business plan, but as a strategic pivot. Corinn’s background in opera demanded relentless dedication, yet financial instability in the arts led her to rethink her path. A simple decision—turning a triplex into an investment instead of a home—set everything in motion.

What started as a personal investment grew into a thriving community of 250+ investors, turning savings into wealth-generating assets. Hearthfire’s disciplined, strategic approach led to a shift from residential real estate to self-storage, leveraging its stability, operational efficiency, and recession-resistant strength.

This commitment to smart investing is why 90% of our investors reinvest.

$180M+

ASSETS UNDER MANAGEMENT

30+

YEARS IN FINANCE & WEALTH MANAGEMENT

250+

INVESTORS

90+

YEARS IN SELF-STORAGE

1M

CUMULATIVE NRSF

30+

YEARS IN TECHNOLOGY

"My opinion of the Hearthfire brand: there aren't lots of bells and whistles or sales pitches, but the results seem to consistently outperform expectations. It's not what you normally experience in the investing world - instead of a fancy sales pitch and overhyped value proposition, you receive plainspoken projections that the company typically exceeds, and you sometimes wish you had invested more in the first place. "

"I guess that was eight or nine years ago, that first property. It was easy and a wonderful return. I just saw from there the company grow and turn into Hearthfire. I have been fortunate that I got to know [Hearthfire] from the get-go and been invited to participate in all the initial offerings and have done quite well."